Bitcoin’s resurgence towards the $73000 mark might herald the initiation of what analysts term as the ‘escape velocity’ phase.

The potential resurgence of Bitcoin to the $73,000 threshold may signify the onset of its journey towards what analysts term as the “escape velocity” phase. This term, borrowed from astrophysics, denotes the critical speed necessary for an object to break free from the gravitational pull of a celestial body without additional propulsion.

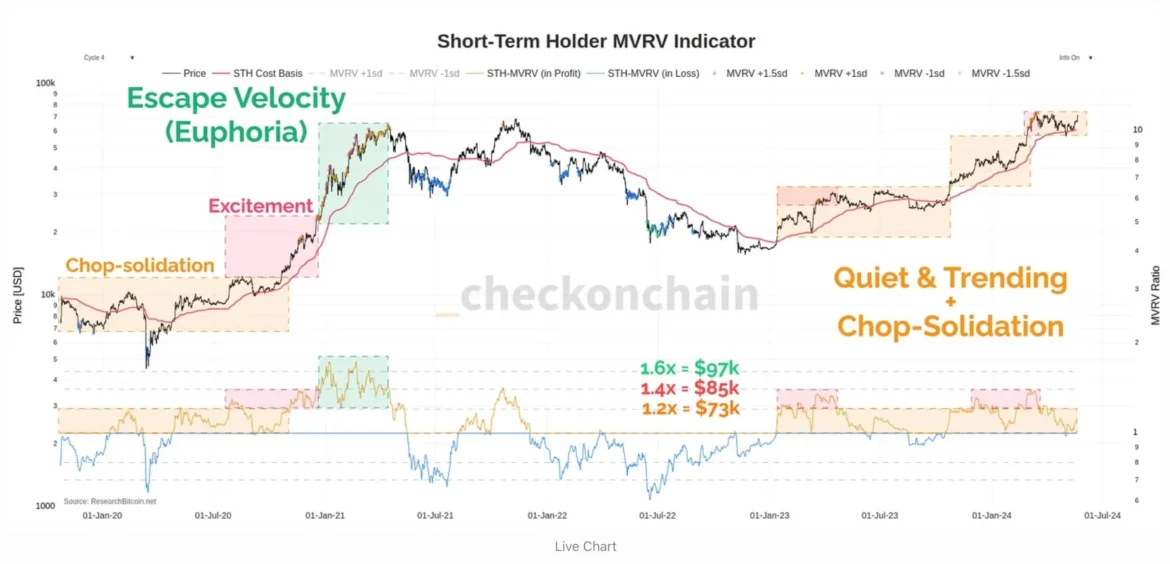

In a recent market analysis, crypto analyst James Check posited that reclaiming the $73,000 price level could propel Bitcoin into this accelerated phase. Check’s assessment revolves around the Short-Term Holder (STH) Market Value to Realized Value (MVRV) metric, indicating that the market remains far from being “overstretched, overbought, and oversaturated.”

Despite this optimistic outlook, Check highlights potential resistance from STH wallets, which may trigger a sell-off as they reach profitable thresholds. Nevertheless, he underscores the absence of euphoric sentiments in the current market, emphasizing a stable and enthusiastic environment conducive to a potential rally at $73,000.

Echoing this sentiment, other analysts note the lack of widespread excitement or euphoria surrounding Bitcoin’s current price levels. This subdued atmosphere suggests that Bitcoin might be poised for further upward momentum, potentially entering a phase of price discovery.

Yoddha, a pseudonymous crypto trader, anticipates Bitcoin reaching its peak before March 18, 2025, citing a consolidation period and projecting a significant uptrend within the next 300 days.

As Bitcoin hovers around $69,088, a surge to $73,000 would represent a modest 5.6% increase, according to CoinMarketCap data.