The rise of binary options as a method for earning money online has sparked apprehension and doubt among traders. This stems from the limited understanding of what binary options entail, how this financial tool operates, and why it yields profits on the internet. Subsequently, traders emerged who grasped the essence of binary options, explaining them in layman’s terms and mastering successful trading strategies.

Stay tuned as we delve into the intricacies of binary options, elucidating their workings, nature, origins, and rationale.

Binary options – what exactly are they?

In essence, a binary option is a financial instrument enabling transactions with trading assets within a stipulated contract duration.

To grasp the concept of binary options and their functionality, consider a straightforward example. Essentially, this instrument resembles a wager (distinct from gambling), wherein a trader predicts whether, within a specified period (e.g., 15 minutes), the price of a stock, currency pair, or cryptocurrency will rise or fall. The trader can then purchase the corresponding option (Call or Put), which automatically expires after the predetermined period (expiration time).

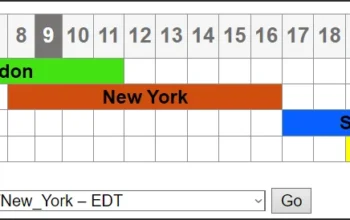

Imagine a trader conducts analysis and predicts that the EUR/GBP currency pair will appreciate over the next 15 minutes. They then purchase a Call (‘Higher’) option with a 15-minute expiry. If the currency pair increases by at least 1 point from the transaction’s opening, the trader can earn a profit of up to 95% (depending on the binary options broker). Hence, correct forecasts yield profits, whereas an adverse price movement results in a loss of the entire investment upon expiry.

In comparison with other market trading, binary options differ in transaction types. When purchasing shares on a stock exchange, for instance, traders profit from rate differentials and can hold positions indefinitely. In binary options trading, however, each transaction is confined by a fixed duration, with price fluctuations being of secondary importance. Upon acquiring binary options, several transaction components become immediately apparent:

1. The prospective profit upon accurate forecast.

2. The potential loss if the forecast proves incorrect.

3. The predetermined transaction expiry time.

This eliminates the need for setting “take-profit” or “stop-loss” orders, often obviating extensive analysis unless dealing with longer-term binary options.

Unlike wagering on sports events, binary options afford opportunities for risk mitigation and enhancing the frequency of profitable transactions. However, achieving this necessitates a thorough understanding of the instrument’s mechanics, alongside adept money and risk management.

Some view binary options trading akin to a casino game, with certain individuals alleging it to be a scam or akin to gambling. Such notions, however, are erroneous and often result in financial losses. Success in binary options trading hinges on effective risk management, capital allocation, and accurate forecasting, facilitated by technical or fundamental analysis tools. Hence, consistent profitability in binary options trading requires expertise and skill acquisition, as relying solely on luck or chance is inadequate.